Garage Door Depreciation Life

We replaced the roof with all new materials replaced all the gutters replaced all the windows and doors replaced the furnace and painted the property s exteriors.

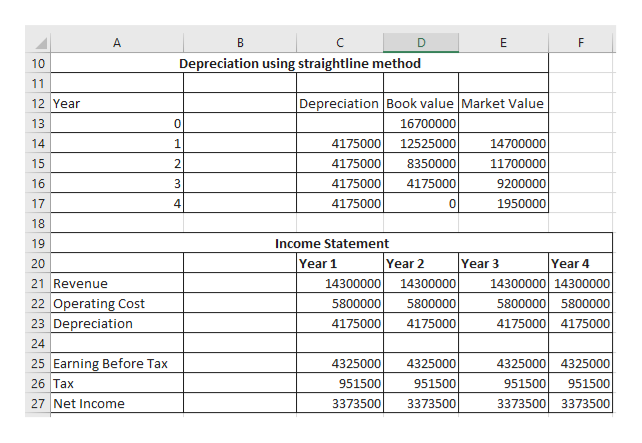

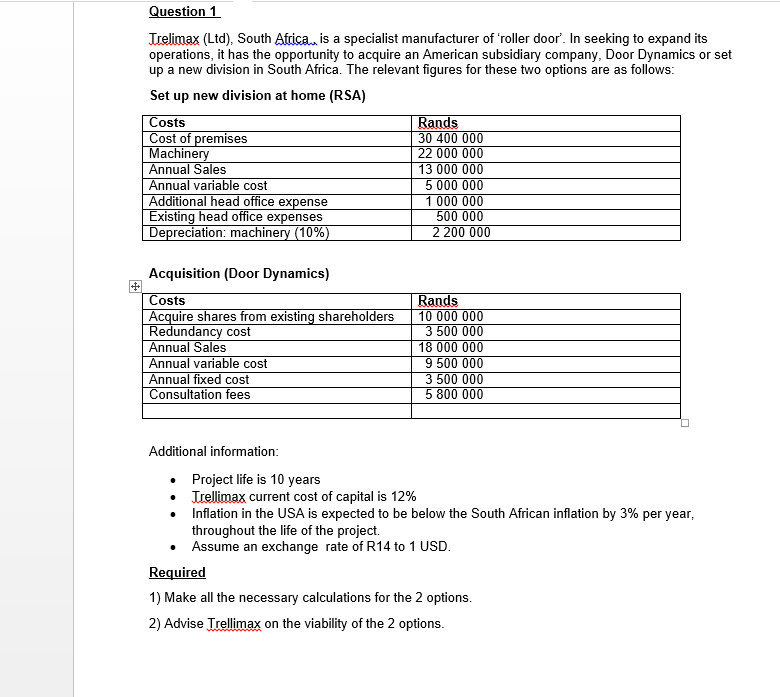

Garage door depreciation life. Garage door overhead door. However under new de minimis rules you are able to deduct the entire cost in the year of purchase. It also provides the effective life of those assets which may be depreciated. It is based on the idea that every asset has a useful life a period of time over which it remains useful and productive.

There are many variables which can affect an item s life expectancy that should be taken into consideration when determining actual cash value. We have incurred costs for substantial work on our residential rental property. Some items may devalue more rapidly. We replaced the door with the same quality and it was 750 so not too expensive.

I am of the opinion that is a new capital asset and is normally depreciated over 27 5 years. Depreciation for residential rental property assets. The table specifies asset lives for property subject to depreciation under the general depreciation system provided in section 168 a of the irc or the alternative depreciation system provided in section 168 g. Building materials doors garage depreciation rate.

Acv rcv dpr rcv age. If you choose to depreciate the garage door opener select appliances carpet furniture category and the software will use the 5 year class life. Depreciation is a business tax deduction regulated by the internal revenue service irs. Rental property garage door replacement.

What are the irs rules concerning depreciation. As to whether the existing garage door had reached it s useful life i think you could argue either way. The macrs asset life table is derived from revenue procedure 87 56 1987 2 cb 674. Doors interior and exterior doors regardless of decoration including but not limited to double opening doors overhead doors revolving doors mall entrance security gates roll up or sliding wire mesh or steel grills and gates and door hardware such as doorknobs closers kick plates hinges locks automatic openers etc.

Door controls and motor drive systems for automatic sliding door s and revolving door s incorporating chains controls motors and sensors but excluding door s 10 years. Just trying to figure out if it s an expense or a depreciable asset. Garage door s electric excluding door s. Because of new de minimis safe harbor rules assets used for more than a year to earn money in profit making activity costing less than 2500 can be expensed instead of depreciated.

I recently replaced a garage door in one of my rental units. At the end of its useful life it is expected to be obsolescent.