Garage Door Depreciation Life Irs

If you choose to depreciate the garage door opener select appliances carpet furniture category and the software will use the 5 year class life.

Garage door depreciation life irs. Depreciation is a business tax deduction regulated by the internal revenue service irs. We have incurred costs for substantial work on our residential rental property. At the end of its useful life it is expected to be obsolescent. Because of new de minimis safe harbor rules assets used for more than a year to earn money in profit making activity costing less than 2500 can be expensed instead of depreciated.

For most landlords the maximum amount that can. Understand the irs rules on improvements including unit of property betterments versus adaptions. Rebuilds the property to a like new condition after the end of its economic useful life or. It does not matter if it was your residence or a rental at the time of the improvement.

Property improvements can be done at any time after your initial purchase of the property. The table specifies asset lives for property subject to depreciation under the general depreciation system provided in section 168 a of the irc or the alternative depreciation system provided in section 168 g. What are the irs rules concerning depreciation. Doors interior and exterior doors regardless of decoration including but not limited to double opening doors overhead doors revolving doors mall entrance security gates roll up or sliding wire mesh or steel grills and gates and door hardware such as doorknobs closers kick plates hinges locks automatic openers etc.

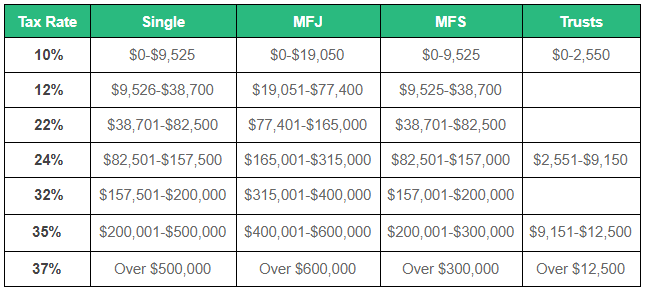

Depreciation for residential rental property assets. Determine the depreciation useful life. It is based on the idea that every asset has a useful life a period of time over which it remains useful and productive. The macrs asset life table is derived from revenue procedure 87 56 1987 2 cb 674.

This is determined based on the type of shed you have. The checklist represents the ato s current views on which assets can be depreciated under division 40 and which assets may be eligible for the building write off under division 43. If your shed is large enough to store a vehicle and has a drive of sorts leading up to it it is classified as a garage for depreciation purposes and has a useful life of 25 years. Expenses for this are entered in the assets depreciation section and depreciated over time.

It also provides the effective life of those assets which may be depreciated.